The Global Impact of Open Data

United Kingdom's HM Land Registry Price Paid Data

Get set, go!

by Becky Hogge

Reference

1 Land Registry. (2006, April). Internet Archive copy of webpage: Welcome to Land Registry’s 10-year strategic plan. Retrieved from Internet Archive: http://web.archive.org/web/20070602044143/http://www.landregistry.gov.uk/strategy/10yearplan/

2 Land Registry. (2006, April). Internet Archive copy of webpage: Welcome to Land Registry’s 10-year strategic plan. Retrieved from Internet Archive: http://web.archive.org/web/20070602044143/http://www.landregistry.gov.uk/strategy/10yearplan/

3 KPMG. (2011). HMLR Feasibility Study.

4 Hogge, B. (2011, May). Open Data Study: New Technologies. Retrieved from Transparency and Accountability Initiative: http://transparencyinitiative.theideabureau.netdna-cdn.com/wp-content/uploads/2011/05/open_data_study_final1.pdf

5 Arthur, C. (2010, November 19). Met Office and Ordnance Survey to be part of ‘public data corporation’. Retrieved from The Guardian: http://www.theguardian.com/technology/2010/nov/19/government-public-data-corporation

6 Department for Business, Innovation & Skills and Cabinet Office. (2011, August 04). A consultation on data policy for a Public Data Corporation: government response. Retrieved from gov.uk: https://www.gov.uk/government/consultations/data-policy-for-a-public-data-corporation

7 Cabinet Office. (2011, November 29). Policy paper: Open data measures in the Autumn Statement 2011. Retrieved from gov.uk: https://www.gov.uk/government/publications/open-data-measures-in-the-autumn-statement-2011

8 Department for Business, Innovation & Skills and Cabinet Office. (2011, August 04). A consultation on data policy for a Public Data Corporation: government response. Retrieved from gov.uk: https://www.gov.uk/government/consultations/data-policy-for-a-public-data-corporation

9 Syal, R. (2014, July 14). Land Registry privatisation plans abandoned by ministers. The Guardian.

10 Quinn, J. (2015, May 20). George Osborne to privatise £23bn of taxpayer assets. Retrieved from The Telegraph: http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/11618980/George-Osborne-to-privatise-23bn-of-taxpayer-assets.html

11 We Own It. (n.d.). Don’t sell of our top trumps. Retrieved September 30, 2015, from http://weownit.org.uk/take-action/dont-sell-our-top-trumps

12 Public Data Group. (n.d.). Public Data Group. Retrieved from gov.uk: https://www.gov.uk/government/groups/public-data-group

13 Interview, Lynne Nicholson, Head of Data Products and Services, HM Land Registry

14 Land Registry. (2012). Privacy Impact Assessment Report: Making price paid data available through publication in a machine readable and reusable format. Retrieved from Land Registry: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/343616/ppd_pia.pdf

15 Land Registry. (2013). Privacy Impact Assessment Review: Price paid data, transaction data and historical price paid data. Retrieved from Land Registry: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/343604/PIA_Report_6_13.pdf

16 Price Paid Dataset does not include title IDs, so unique addresses were used as a proxy. The author downloaded the dataset on 21 September 2015, and queried it for the number of entries with a unique Postcode/PAON/SAON combination.

18 An FOI request for the same dataset is available at (Bowden 2015)

19 Private Eye. (2015). In the back: Selling England by the offshore pound. Retrieved from Private Eye: http://www.private-eye.co.uk/registry

20 Land Registry. (2014, August 14). INSPIRE Index Polygons spatial data > conditions of use. Retrieved from gov.uk: https://www.gov.uk/guidance/inspire-index-polygons-spatial-data#conditions-of-use

21 legislation.gov.uk. (n.d.). Copyright, Designs and Patents Act 1988. Retrieved September 30, 2015, from legislation.gov.uk: http://www.legislation.gov.uk/ukpga/1988/48/section/30

22 As well as these categories of data, which all relate to location, meteorological data, transport data, health, education, and crime statistics were all cited by respondents as having particular societal benefits. Department for Business, Innovation & Skills and Cabinet Office. (2011, August 04). A consultation on data policy for a Public Data Corporation: government response. Retrieved from gov.uk: https://www.gov.uk/government/consultations/data-policy-for-a-public-data-corporation

23 Interview, Lynne Nicholson, Head of Data Products and Services, HM Land Registry

24 Department for Communities and Local Government. (2010, February 09). Property sales based on Land Registry data. Retrieved from data.gov.uk: https://data.gov.uk/dataset/property_sales_based_on_land_registry_data

25 Department for Communities and Local Government. (2010, September 09). Median house price. Retrieved from data.gov.uk: https://data.gov.uk/dataset/median_house_price

26 HM Treasury. (2012, 02 13). Public Data Group Business Case. Retrieved from gov.uk: https://www.gov.uk/government/publications/open-data-public-data-group-business-case

27 Interview, Lynne Nicholson, Head of Data Products and Services, HM Land Registry

28 Interview, Lynne Nicholson, Head of Data Products and Services, HM Land Registry

29 Cabinet Office. (2011, August 04). Making Open Data Real. Retrieved from gov.uk: https://www.gov.uk/government/consultations/making-open-data-real

30 Interview, Lynne Nicholson, Head of Data Products and Services, HM Land Registry

31 Land Registry. (2013). Privacy Impact Assessment Review: Price paid data, transaction data and historical price paid data. Retrieved from Land Registry: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/343604/PIA_Report_6_13.pdf

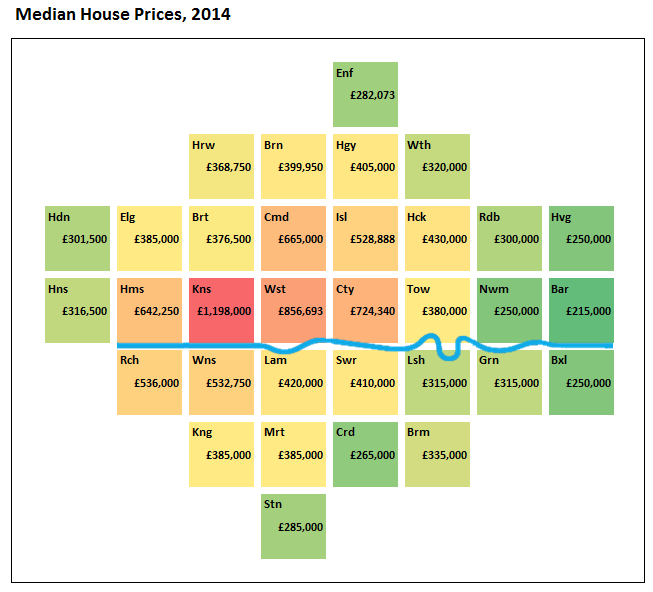

32 Mapping London. (2015, March 19). House Prices: A Borough Cartogram. Retrieved from Mapping London: http://mappinglondon.co.uk/2015/house-prices-a-borough-cartogram/

33 Ramsay, F. (2014, July 03). Telling stories with open data and maps. Retrieved from Land Registry: http://blog.landregistry.gov.uk/using-open-data-map-future/

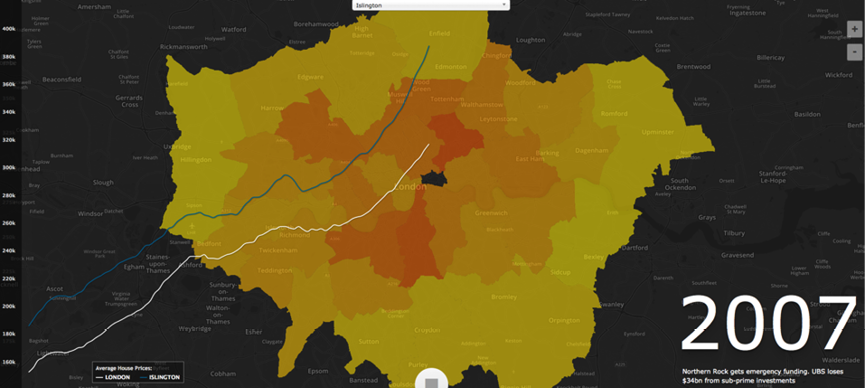

34 Timita, M. (2014, February 27). London house prices: evolution over 13 years. Retrieved from Illustreets: http://illustreets.co.uk/blog/maps-and-apps/london-house-prices-evolution-over-13-years/

35 Ramsay, F. (2014, July 03). Telling stories with open data and maps. Retrieved from Land Registry: http://blog.landregistry.gov.uk/using-open-data-map-future/

36 Interview, Adrian Black, Founder and Managing Director, YOUhome

37 Interview, Adrian Black, Founder and Managing Director, YOUhome

38 Interview, Adrian Black, Founder and Managing Director, YOUhome

39 Interview, Henry Pryor, Independent Residential Property Expert

40 Assetti. (2015, June 14). The Rise of the New Property Technology (Prop Tech). Retrieved from assetti.pro: http://assetti.pro/en/2015/06/14/the-rise-of-the-new-property-technology-prop-tech/

41 Fowler, R. (2015, June 23). Looking at the future of #proptech. Retrieved from Tech City News: http://techcitynews.com/2015/06/23/looking-at-the-future-of-proptech/

42 Interview, Peter Thum-Bonanno, Co-founder and CTO, GetAgent

43 Interview, Peter Thum-Bonanno, Co-founder and CTO, GetAgent

45 Interview, Vasanth Subrahmanian, Co-founder and CTO, Splittable

46 Interview, Vasanth Subrahmanian, Co-founder and CTO, Splittable

47 Interview, Henry Pryor, Independent Residential Property Expert

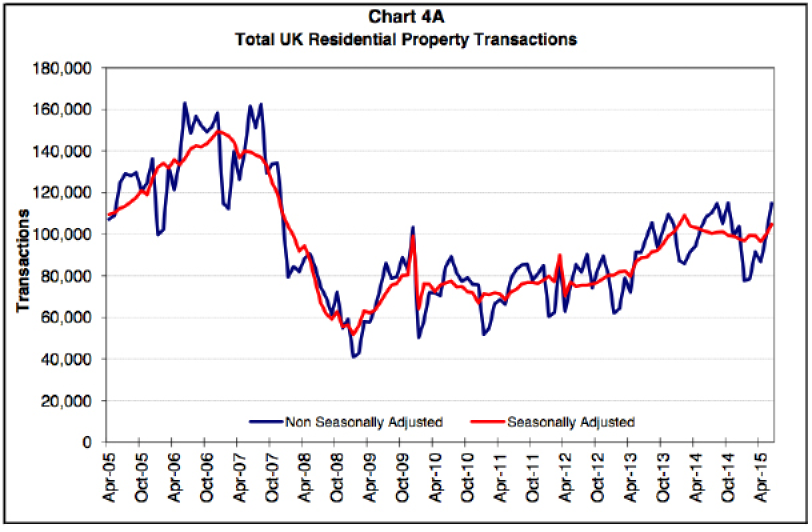

48 HMRC. (2015, September 22). UK Property Transaction Statistics. Retrieved from gov.uk: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/461354/UK_Tables_Sep_2015__cir_.pdf

49 OECD. (n.d.). Focus on house prices. Retrieved September 30, 2015, from OECD: http://www.oecd.org/eco/outlook/focusonhouseprices.htm

50 HMRC. (2015, September 22). UK Property Transaction Statistics. Retrieved from gov.uk: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/461354/UK_Tables_Sep_2015__cir_.pdf

51 Interview, Lynne Nicholson, Head of Data Products and Services, HM Land Registry

52 Land Registry. (2013). Privacy Impact Assessment Review: Price paid data, transaction data and historical price paid data. Retrieved from Land Registry: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/343604/PIA_Report_6_13.pdf

53 Interview, Lynne Nicholson, Head of Data Products and Services, HM Land Registry

54 Interview, Peter Thum-Bonanno, Co-founder and CTO, GetAgent

55 Interview, Claudia Arney, Chair, Public Data Group 2012-2015

56 Aston, S. (2015, March 13). Graham Farrant to replace Ed Lester as Land Registry chief. Retrieved from Civil Service World: https://www.civilserviceworld.com/articles/news/graham-farrant-replace-ed-lester-land-registry-chief

57 Hope, C. (2013, April 19). Everyone’s postcodes to be privatised in Royal Mail flotation, despite objections from Sir Tim Berners-Lee. Retrieved from The Daily Telegraph: http://www.telegraph.co.uk/news/uknews/royal-mail/9994741/Everyones-postcodes-to-be-privatised-in-Royal-Mail-flotation-despite-objections-from-Sir-Tim-Berners-Lee.html

58 Arthur, C. (2014, March 17). MPs and open-data advocates slam postcode selloff. Retrieved from The Guardian: http://www.theguardian.com/technology/2014/mar/17/mps-and-open-data-advocates-slam-postcode-selloff